A W-2, known officially as a “Wage and Tax

Statement,” is a tax

form employees use to file federal

and state taxes. The form shows the amount of taxes

withheld from the employee’s paycheck for the year,

and paid directly to the IRS and state

government by

their employer.

When you’re ready to complete

your W-2s for the

year, you will

need the following information at

your fingertips:

Have this information ready? File your Form W-2 in less than 2 minutes.

Remember that you’ll

need to prepare and deliver a different W-2 form for

each employee.

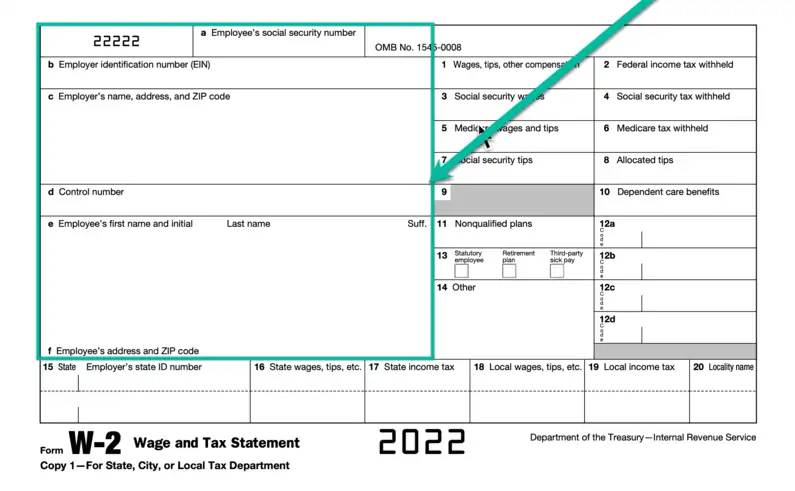

Boxes A-F on a W-2 represents employee/employer information:

Misspelling your name or SSN in the W-2 form will most likely

result in your employer rejecting it;

so make sure the information is entered correctly

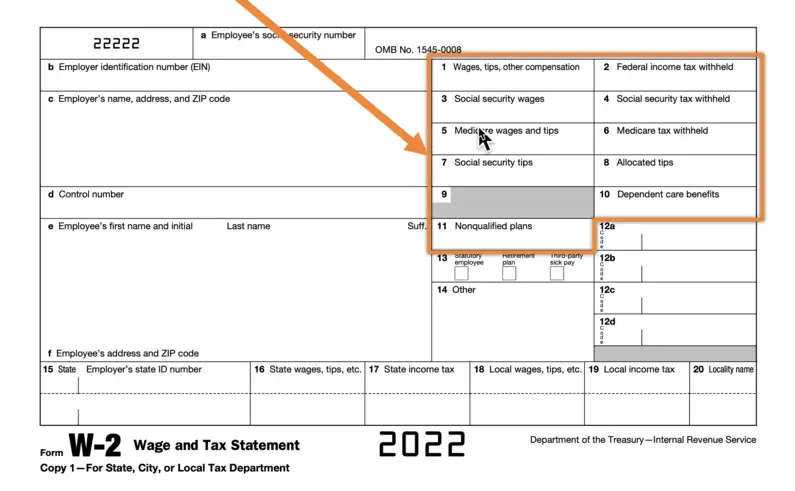

Proper entry of the wages and tips is extremely important to avoid surprises during the tax season as you may end up owing money to the IRS. On the other hand, if you overreport your deductions, you will end up with a smaller take-home amount in your paycheck, but a larger tax refund at the end of the year which is like giving the IRS a free loan

Make sure you enter the correct value for dependent care benefits as it will also affect the amount of tax withheld from your paycheck