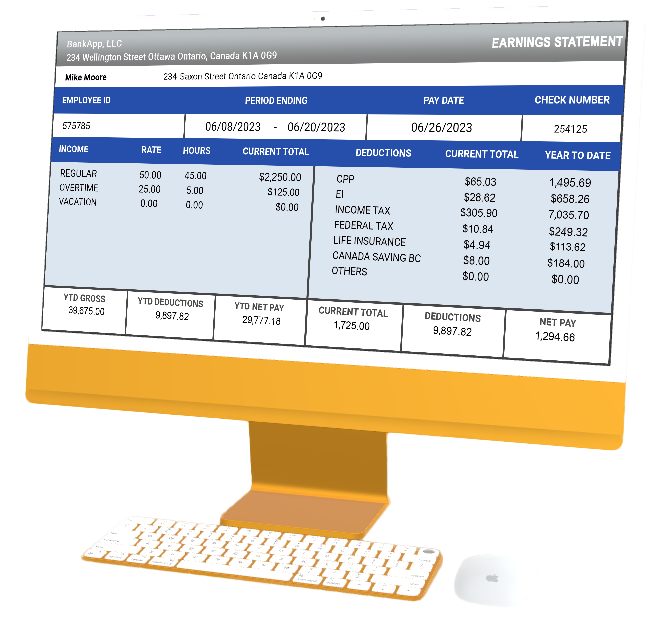

Simply enter the information about your company, employee, income, and deductions to create an example professional pay stub instantly. Note that the start date is by default Jan. 1 and this tool is only for salary-based income employees. You can save the pay stub as a PDF to email to your employee or keep it for your records.Keep your records and documents in one place so you’re prepared for tax time. Here are a few other helpful tips:

Automate payroll and concentrate on growing your business.

Manage payroll yourself and save while doing it. See Payroll Pricing

Pay employees accurately and on time to increase their productivity.

Deliver error-free paychecks, W-2s, and payroll reports.

Stay in compliance with IRS laws and reporting requirements.

Improve the efficiency of your company and employees.