Generate 100% Legal UK

Payslips Instantly

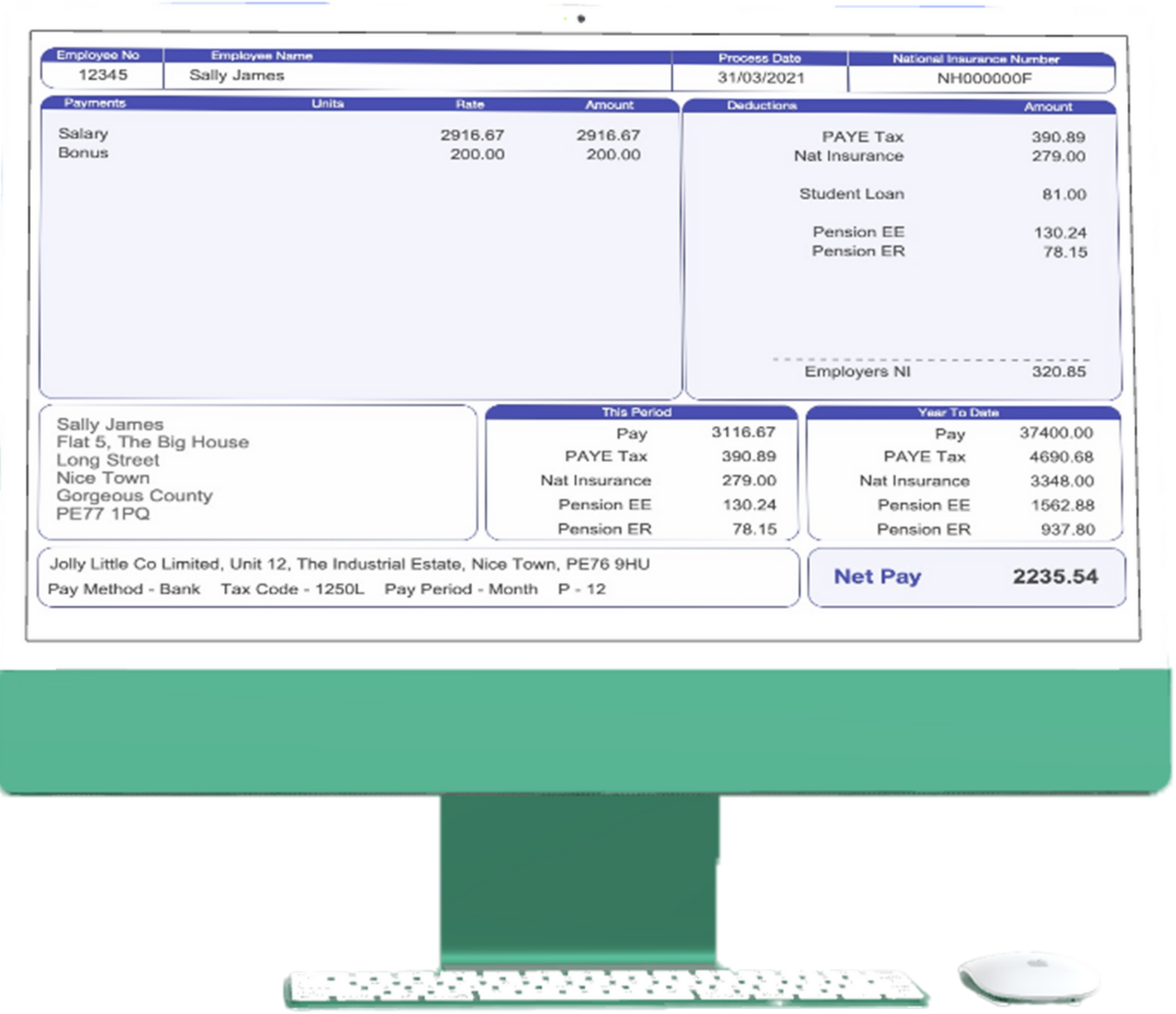

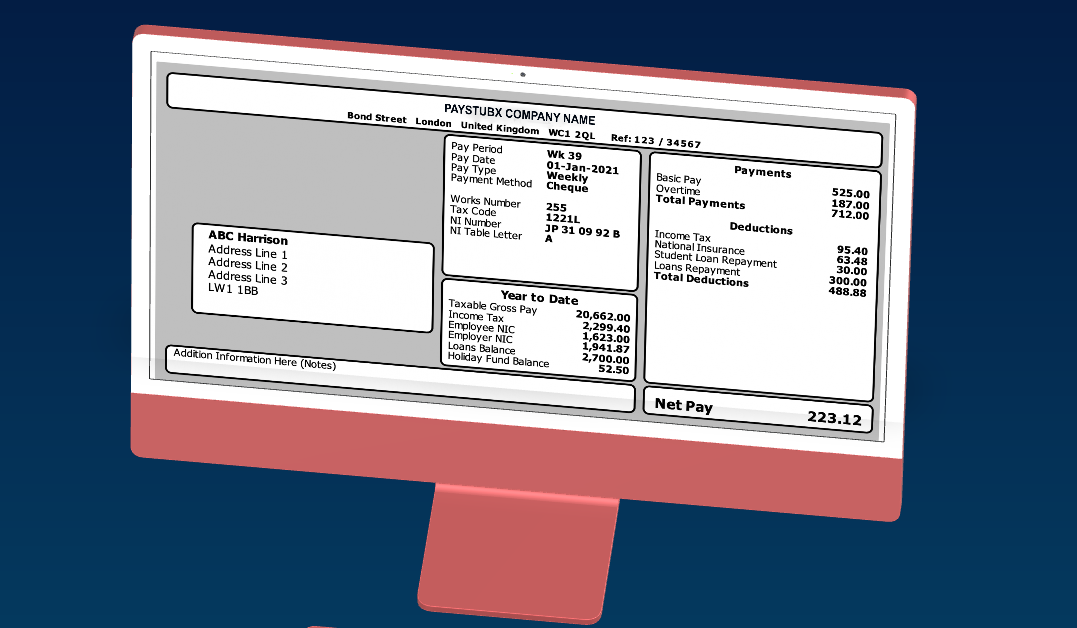

Basic pay: this is your earnings before deductions. A ‘deduction’ is money taken off, like a tax for example.

Net pay: this is your earnings after deductions. This tends to be the most interesting number since it’s what will actually be paid into your bank account.

Variable deductions: these are deductions that may change each time you’re paid, such as sick pay.

Your payroll number: some companies use payroll numbers to help them identify employees on their payroll.

Your tax code: This code normally starts with a number and ends with a letter. It tells your employer how much tax you should pay – so if it’s wrong, you may pay too much.

Your National Insurance (NI) number: This is used to help HMRC track your income so they can tax you the correct amount. It never changes, so it should be exactly the same on all your payslips.

Your payslip must show the total amount you’ve earned. Sometimes, your employer breaks this down into categories, such as:

Basic pay: this is how much you’ve earned before any ‘extras’ (for example, commission)

Commission and bonuses: this may be what you’ve earned on top of your usual salary, usually for doing well at your job.

Overtime: some employers may pay you extra for working overtime, or a higher rate for working on weekends, for example.

Expenses reimbursement: if you bought something you need for your job – such as petrol or stationery – some employers will pay you back. They may include this in your payslip or do it separately.

Sick pay: if you’re too ill to work, you may be entitled to Statutory Sick Pay and/or occupational sick pay. This would replace your usual pay while you’re off ill.

Maternity, paternity, and adoption pay: these may replace your usual pay if you’re off work because you have a new child.

Workplace benefits: these might include things like healthcare insurance or a company car.

A deduction is money taken off your earnings before you’re paid.

Income tax: this may also appear as ‘PAYE tax’ on your payslip. How much income tax you should pay depends on your tax code.

Pension contributions: some employees give up part of their salary to be paid into a workplace pension. Pension contributions from your employer may also be shown.

Student loan payments: if you’re repaying a student loan, your employer will take the money directly out of your salary to give to the Student Loans Company.

Court orders and child maintenance: your employer may be asked to take money directly from your pay packet for things like unpaid fines, debt repayments, and child maintenance.

Repayments for workplace benefits: some employers offer loans for things like rail season tickets. They’ll usually take the repayments directly from your earnings.

Payroll Giving: this is a scheme that allows employees to donate to charity directly from their pay.

Pay date: this is the date the money should be paid into your bank account.

Pay method: this is how you’ll be paid, for example, by BACS (i.e., directly into your bank account).

Tax period: this is the period of time you’ve been taxed for. It’s usually shown as the month number, e.g., ‘02’ to mean February.

Summary of the year to date: Your payslip may show your total earnings, deductions, and pay for the current financial year (which runs from 6 April to 5 April). This can be particularly helpful for checking if you’ve been taxed correctly.